AOL's focus on ad serving starts rewarding

/In June of 2011 I wrote how AOL was re-aligning itself and becoming more focussed. It's proven business model of ad serving and collecting media outlets that bolstered that model was to set a base of ad serving growth.

And it has.

Fourth quarter 2011 highlights:

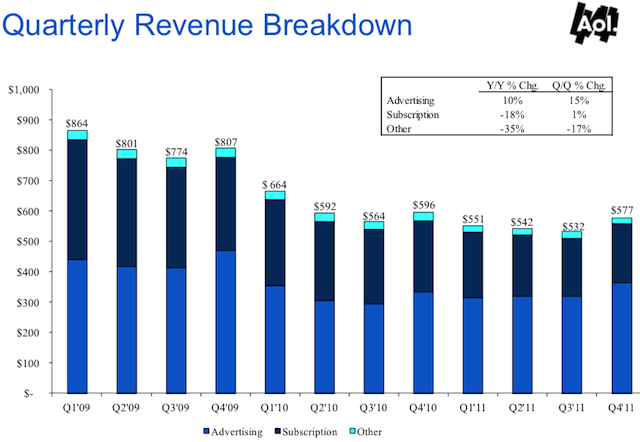

- AOL grew global advertising revenue by 10 percent — its third consecutive quarter of year-over-year growth.

- Total revenue decline was its lowest rate of revenue decline in 5 years.

- 15 percent growth in global display revenue — AOL’s fourth consecutive quarter of year-over-year growth.

- AOL reported the lowest rate of search and contextual revenue decline in approximately 3 years, due in large part to growth in search revenue on AOL.com.

- Dial up subscription revenue declined 18 percent (lowest rate of decline in five years), with a monthly average churn of 2.2 percent year-over-year.

- AOL’s Adjusted OIBDA expensess, excluding Traffic Acquisition Costs (TAC) and an $8.5 million legal settlement were $360.4 million, down from $391.3 million and $368.0 million in Q2 and Q3 2011, respectively.

- AOL’s operating income and Adjusted OIBDA grew $46.2 million and $37.4 million sequentially. Both declined year-over-year due to lower total revenue, strategic investments and an $8.5 million legal settlement. Net income declines year-over-year also reflect the gain on sale of AOL’s investment in Brightcove in Q4 2010.

Nice job staying focussed AOL.